U-Haul Stock: A Comprehensive Guide to Investing in the Iconic Moving and Storage Giant

Introduction: Unpacking the Value of U-Haul Stock

When most people think of U-Haul, they picture the familiar orange and white rental trucks traversing highways and city streets, synonymous with the excitement and stress of moving day. However, for investors, "U-Haul stock" refers to shares of AMERCO (NYSE: UHAL), the parent company that owns and operates the U-Haul brand along with its significant self-storage and insurance businesses. Far from being just a truck rental company, AMERCO represents a unique investment opportunity, blending essential consumer services with a robust real estate portfolio and a diversified financial services arm.

Investing in UHAL means buying into a company that has been an integral part of the American landscape for nearly 80 years. Its stock can offer insights into broader economic trends, such as migration patterns, housing market health, and consumer spending on essential services. This comprehensive guide will delve into the intricacies of U-Haul stock, exploring its business model, investment theses, performance drivers, and practical advice for potential investors looking to understand or add this distinctive company to their portfolio.

Company Overview: Beyond the Orange Truck

To truly understand U-Haul stock, one must first appreciate the breadth of AMERCO’s operations. Founded in 1945, U-Haul revolutionized the do-it-yourself moving industry. Today, AMERCO operates primarily through three distinct but synergistic segments:

-

Moving and Storage: This is the flagship segment, encompassing the rental of trucks, trailers, and towing devices, along with portable storage solutions (U-Box) and a vast network of self-storage facilities. U-Haul boasts an unparalleled network of over 23,000 locations across North America, including company-operated stores and independent dealers. The self-storage component has grown significantly, transforming U-Haul into one of the largest self-storage operators, owning and managing millions of square feet of rentable space. This segment benefits from both geographic mobility and the need for temporary or long-term storage solutions, often acting as a first-mover advantage in acquiring prime real estate.

-

Property and Casualty Insurance (Repwest Insurance Company): This segment provides property and casualty insurance primarily to U-Haul customers (e.g., Safemove® and Safestor® insurance products) and to the U-Haul system itself. This captive insurance operation helps manage risk internally, providing a stable, recurring revenue stream and contributing to the overall profitability and financial stability of AMERCO.

-

Life Insurance (Oxford Life Insurance Company): Oxford Life, acquired in 1999, offers life insurance, annuities, and Medicare supplement products. While distinct from the core U-Haul business, it further diversifies AMERCO’s revenue streams and provides an additional layer of financial strength, helping to balance out potential cyclicality in the moving and storage sector.

This diversified structure means that investing in UHAL is not just a bet on truck rentals but a multi-faceted play on consumer mobility, real estate, and financial services, providing a unique blend of stability and growth potential.

Why Invest in U-Haul Stock? Key Investment Theses

Investors consider U-Haul stock for several compelling reasons, rooted in its robust business model and market position:

- Resilience and Brand Recognition: U-Haul is a household name, instantly recognizable across North America. It provides an essential service that remains in demand regardless of economic conditions; people move for various reasons in both good times and bad (job changes, downsizing, growth, housing market shifts). This fundamental demand provides a degree of recession resistance.

- Significant Real Estate Portfolio: A major hidden asset of AMERCO is its vast real estate holdings. The company strategically acquires and develops properties for its self-storage facilities and U-Haul centers, often in high-traffic, accessible locations. This real estate component offers tangible asset backing, potential for appreciation, and a stable foundation for its operations, making it partly a real estate investment trust (REIT) in disguise, though not structured as one.

- Growth in Self-Storage: The self-storage industry has experienced consistent growth, driven by urbanization, smaller living spaces, and consumer accumulation of goods. U-Haul has aggressively expanded its self-storage footprint, converting existing properties and acquiring new ones. This segment typically boasts high-profit margins and recurring revenue, contributing significantly to AMERCO’s bottom line.

- Counter-Cyclical/Economic Bellwether Aspects: While not entirely immune, U-Haul’s business can exhibit counter-cyclical tendencies. In economic downturns, people may downsize or relocate for new job opportunities, increasing demand for affordable moving solutions and storage. Conversely, a booming housing market also drives moves. Furthermore, U-Haul’s vast network provides unique insights into population migration patterns within and between states.

- Asset-Light Dealer Network: A significant portion of U-Haul’s rental locations are operated by independent dealers. This "asset-light" approach allows U-Haul to expand its reach without incurring the full capital expenditure of owning every location, providing flexibility and scalability.

- Strong Balance Sheet and Capital Reinvestment: AMERCO generally prioritizes reinvesting its profits back into the business – expanding its fleet, acquiring real estate, and enhancing technology – rather than paying a regular dividend. This strategy, common for growth-oriented companies, aims to compound value for shareholders through capital appreciation.

Understanding AMERCO (UHAL) Stock Performance

AMERCO’s stock performance is influenced by a confluence of factors, reflecting its diverse operations:

- Economic Cycles: While resilient, U-Haul’s performance is tied to overall economic health, especially housing market activity and consumer confidence. A robust housing market with high transaction volumes generally benefits moving services.

- Fuel Costs: As a major operator of vehicles, fuel prices directly impact U-Haul’s operational expenses and, potentially, customer demand for longer-distance moves.

- Interest Rates: Changes in interest rates can affect AMERCO in several ways: the cost of financing real estate acquisitions, the attractiveness of its financial products (annuities), and consumer borrowing behavior for home purchases.

- Competition: U-Haul faces competition from other national rental companies (e.g., Penske, Budget) and local storage facilities. Its extensive network and brand loyalty, however, provide a strong competitive moat.

- Capital Expenditures: The company continuously invests in its fleet and real estate. The timing and effectiveness of these investments can impact short-term profitability but are crucial for long-term growth.

- Geographic Migration: Population shifts between states and regions directly translate into moving demand, and U-Haul’s extensive data can provide a leading indicator for these trends.

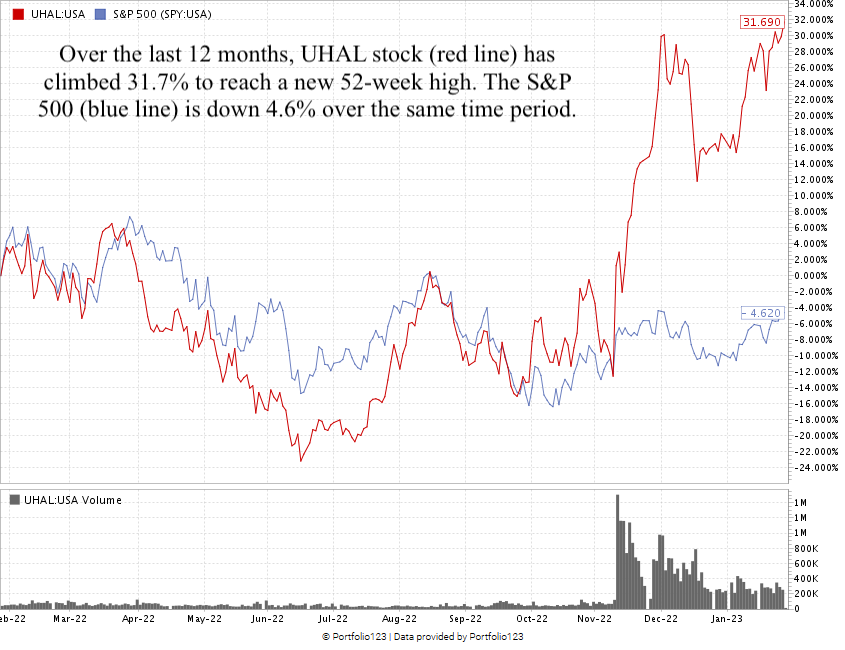

Historically, UHAL has demonstrated strong long-term growth, albeit with periods of volatility mirroring broader market and economic fluctuations. Its real estate holdings provide a solid base, while the service components offer operational leverage.

How to Invest in U-Haul Stock (UHAL)

Investing in U-Haul stock is straightforward, as it is a publicly traded company on the New York Stock Exchange (NYSE). Here’s a step-by-step guide:

- Choose a Brokerage Account: You’ll need a brokerage account to buy stocks. Popular options include online brokers like Fidelity, Charles Schwab, E*TRADE, Vanguard, or Robinhood. Research to find one that suits your needs regarding fees, research tools, and customer service.

- Open and Fund Your Account: Complete the application process, which typically involves providing personal information and linking a bank account. Once approved, transfer funds from your bank account to your brokerage account.

- Research UHAL: Before buying, conduct your due diligence. Review AMERCO’s financial reports (10-K, 10-Q), investor presentations, and analyst reports. Understand its business segments, financial health, and future prospects.

- Place an Order:

- Find the Stock: In your brokerage platform, search for "AMERCO" or its ticker symbol "UHAL."

- Specify Quantity: Decide how many shares you want to buy.

- Choose Order Type:

- Market Order: Buys or sells shares immediately at the best available current price. This is quick but can have price slippage in volatile markets.

- Limit Order: Buys or sells shares only at a specified price or better. This gives you more control over the price you pay but may not execute if the stock doesn’t reach your limit.

- Review and Execute: Double-check your order details before confirming.

For long-term investors, strategies like dollar-cost averaging (investing a fixed amount regularly, regardless of price) can help mitigate volatility and build a position over time.

Important Considerations & Due Diligence

Before committing capital to U-Haul stock, consider these factors:

- Valuation: Assess key financial metrics such as Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, Debt-to-Equity ratio, and Free Cash Flow. Compare these to industry averages and AMERCO’s historical figures to determine if the stock is undervalued or overvalued. Given its real estate component, also consider metrics like Funds From Operations (FFO) or Net Asset Value (NAV).

- Management and Strategy: Evaluate the leadership team’s experience, track record, and stated strategic vision. How are they addressing market changes, competition, and technological advancements?

- Balance Sheet Health: Examine AMERCO’s debt levels, cash reserves, and liquidity. A strong balance sheet provides resilience during economic downturns and flexibility for growth initiatives.

- Capital Expenditures: Understand the company’s ongoing capital needs for fleet replacement, maintenance, and real estate development. These are significant and can impact short-term earnings.

- Shareholder Returns: As noted, AMERCO typically reinvests profits rather than paying dividends. Investors should focus on capital appreciation and the long-term growth of the company’s underlying assets and earnings.

- ESG Factors: Consider environmental, social, and governance factors. How is U-Haul addressing its environmental footprint (e.g., fuel efficiency, electric vehicle potential)? What are its labor practices and corporate governance standards?

Potential Challenges and Solutions

While U-Haul presents an attractive investment, it also faces potential challenges:

- Fleet Maintenance and Depreciation: Maintaining a massive fleet of vehicles is a continuous and costly endeavor. Trucks depreciate, require regular servicing, and eventually need replacement, demanding significant capital expenditure.

- Solution: U-Haul’s scale allows for efficient procurement and maintenance, and its asset-light dealer model helps manage some of these costs. Strategic planning for fleet renewal is crucial.

- Technological Disruption and Changing Consumer Behavior: The rise of app-based services and shifting consumer preferences for convenience could impact traditional rental models.

- Solution: U-Haul has invested in digital solutions like online reservations, mobile check-in/checkout, and digital key access for storage units, adapting to modern consumer expectations.

- Economic Sensitivity: Despite some resilience, a severe and prolonged economic downturn, particularly one impacting housing transactions or consumer discretionary spending, could negatively affect demand.

- Solution: Diversification into self-storage and insurance provides buffers. Its focus on affordable, DIY solutions can also be a strength in tighter economic times.

- Fuel Price Volatility: Spikes in fuel prices can squeeze margins and potentially deter customers from long-distance moves.

- Solution: U-Haul can pass some costs to consumers, and its focus on local moves (which are less sensitive to fuel prices) and the growing self-storage segment provide some insulation.

- Real Estate Market Cycles: While a strength, a significant downturn in real estate values could impact the value of AMERCO’s vast property portfolio.

- Solution: U-Haul’s strategic acquisitions, often below market value for conversion, and its long-term hold strategy help mitigate short-term market fluctuations.

Tips for Potential Investors

- Think Long-Term: U-Haul is not a "get rich quick" stock. Its value proposition lies in consistent, long-term growth driven by real estate appreciation and steady service demand.

- Diversify: Never put all your investment capital into a single stock. UHAL should be part of a well-diversified portfolio that aligns with your risk tolerance and financial goals.

- Stay Informed: Regularly review AMERCO’s quarterly and annual reports, listen to earnings calls, and follow industry news to stay updated on company performance and market trends.

- Understand the Business Model: Be clear about how each segment (moving, storage, insurance) contributes to the company’s overall financial health and how they interact.

- Monitor Macroeconomic Trends: Keep an eye on housing market data, migration trends, interest rate policies, and fuel prices, as these can significantly impact U-Haul’s business.

U-Haul Stock (AMERCO – UHAL) Key Information Snapshot

(Please note: Stock prices and financial metrics are subject to constant change. The "Current Price" and other specific financial figures below are illustrative examples based on historical data and market conditions at the time of writing, not real-time data. Always refer to a live brokerage platform or financial news source for the most up-to-date information.)

| Metric | Value (Illustrative Example) | Description |

|---|---|---|

| Ticker Symbol | UHAL | Unique identifier for AMERCO stock on the NYSE. |

| Company Name | AMERCO | Parent company of U-Haul International, Repwest, and Oxford Life. |

| Exchange | New York Stock Exchange (NYSE) | Where AMERCO shares are publicly traded. |

| Current Price | ~$650.00 | Approximate price per share (example only, actual price varies daily). |

| 52-Week Range | ~$500.00 – ~$750.00 | The highest and lowest prices the stock has traded at over the past year (example only). |

| Market Capitalization | ~$12.5 Billion | Total value of all outstanding shares (shares x current price). |

| P/E Ratio (TTM) | ~15-20x | Price-to-Earnings ratio over the Trailing Twelve Months, indicating how much investors are willing to pay per dollar of earnings (example). |

| Dividend Yield | N/A (or very low, infrequent special dividends) | AMERCO generally reinvests profits rather than paying regular dividends. |

| Earnings Per Share (EPS) TTM | ~$35.00 – ~$45.00 | Company’s profit allocated to each outstanding share over the last 12 months (example). |

| Beta | ~1.0 – 1.2 | Measures stock’s volatility relative to the overall market (S&P 500). Beta > 1 suggests higher volatility. |

| Sector | Industrials / Real Estate (blended due to diverse operations) | Primary industry classification. UHAL has elements of both transportation/logistics and real estate. |

| Industry | Truck Rental & Leasing / Self-Storage / Insurance | More specific industry classifications. |

Concluding Summary: A Unique Blend of Stability and Growth

U-Haul stock, through its parent company AMERCO, offers investors a unique blend of exposure to essential consumer services, a substantial and appreciating real estate portfolio, and diversified financial operations. It is a company deeply embedded in the fabric of North American mobility, providing services that remain in demand through various economic cycles. While not without its challenges, AMERCO’s strong brand, vast network, strategic real estate acquisitions, and commitment to reinvestment position it as a compelling, long-term investment opportunity.

For those seeking to understand the nuances of the moving, storage, and real estate sectors, or for investors looking for a company with tangible assets and a proven track record, UHAL presents an intriguing option. Its continued adaptation to market demands and strategic growth in high-margin segments like self-storage suggest a resilient business model poised for ongoing value creation.

Frequently Asked Questions (FAQ) about U-Haul Stock

Q1: What is the ticker symbol for U-Haul stock?

A1: The ticker symbol for AMERCO, the parent company of U-Haul, is UHAL on the New York Stock Exchange (NYSE).

Q2: Does U-Haul (AMERCO) pay dividends?

A2: AMERCO generally does not pay regular cash dividends. The company typically reinvests its earnings back into the business for growth initiatives, such as fleet expansion and real estate acquisitions. While special, one-off dividends have occurred in the past, they are not a regular feature of UHAL’s shareholder return policy.

Q3: Is U-Haul stock a good investment?

A3: Whether U-Haul stock is a "good" investment depends on an individual investor’s financial goals, risk tolerance, and investment horizon. It offers a unique blend of essential services, a significant real estate portfolio, and diversified income streams. Its resilience and growth in the self-storage sector are attractive, but investors should consider its valuation, economic sensitivities, and long-term strategy before investing.

Q4: What are the main businesses of AMERCO?

A4: AMERCO operates primarily through three segments: Moving and Storage (U-Haul truck/trailer rentals, U-Box portable storage, and self-storage facilities), Property and Casualty Insurance (Repwest Insurance Company), and Life Insurance (Oxford Life Insurance Company).

Q5: How does the housing market affect U-Haul’s business?

A5: The housing market significantly impacts U-Haul. A robust housing market with high transaction volumes (buying and selling homes) generally increases demand for moving services. Conversely, a slowdown in the housing market can reduce demand. However, U-Haul also benefits from other types of moves (job relocation, downsizing, student moves) and its self-storage business, which can be less sensitive to housing market fluctuations.

Q6: Is U-Haul stock volatile?

A6: Like many stocks, UHAL can experience volatility due to economic factors, fuel price fluctuations, interest rate changes, and overall market sentiment. Its Beta (a measure of volatility relative to the market) typically hovers around 1.0 to 1.2, suggesting it can be slightly more volatile than the broader market at times, but generally moves in line with it.

Q7: How does U-Haul compete with other rental companies?

A7: U-Haul competes through its extensive network of locations (company-owned and independent dealers), strong brand recognition, diverse fleet options, and integrated self-storage solutions. Its focus on the do-it-yourself moving market and competitive pricing are key differentiators.

Q8: What is the significance of U-Haul’s real estate holdings?

A8: U-Haul’s real estate holdings are a critical asset, providing tangible value, operational stability for its self-storage and moving centers, and potential for long-term appreciation. These properties often serve dual purposes, housing rental operations and self-storage units, contributing significantly to the company’s asset base and future growth potential.