Truck Financing Options in Portland – Get Approved Fast

truck financing in Portland Oregon – When securing truck financing in Portland, the process can seem daunting, but with the right knowledge and strategy, you can get approved fast. Whether you’re looking for a personal vehicle or need to expand your business fleet, understanding the financing options available will ensure you make the best decision. Portland offers a variety of loan products, lenders, and dealership financing programs tailored for truck buyers. Here’s an in-depth guide on navigating through these truck financing options, ensuring a smooth and swift approval process.

Why Financing a Truck Makes Sense in Portland

In Portland, where the need for heavy-duty trucks and commercial vehicles is high, buying a truck outright may not always be a feasible option. Financing allows you to spread the cost over time, making it affordable and leaving your capital free for other business or personal needs. Portland’s truck market also offers a vast array of options, from Ram 2500 and 3500 heavy-duty trucks to lighter utility trucks, making financing an essential tool for many buyers.

Choosing finance also opens doors to the latest models with better technology and higher efficiency, which is particularly crucial for businesses relying on truck performance. With favorable loan terms, competitive interest rates, and Portland’s booming commercial sector, financing a truck today can provide you with a vital asset that enhances productivity and keeps your business moving forward.

Types of Truck Financing in Portland

There are several truck financing options available in Portland. These options range from traditional bank loans to dealership financing and even leasing options for those who want lower monthly payments. Let’s take a closer look at the most common ways to finance a truck:

1. Bank Loans

Bank loans are a classic financing route. Banks in Portland offer a range of loan products specifically designed for vehicle purchases, including trucks. With a bank loan, you can expect:

- Fixed interest rates, allow you to budget for monthly payments over the life of the loan.

- The opportunity to pre-qualify for the loan gives you leverage during the truck negotiation process.

- Longer loan terms, ranging from 36 to 72 months or more, depending on the truck’s value and your financial profile.

Bank loans, however, may come with stricter eligibility criteria, including high credit score requirements, a solid financial history, and often a large down payment. Despite this, for those with a strong credit score, bank loans can offer some of the best interest rates in the market.

2. Dealership Financing

Many truck dealerships in Portland, especially those that specialize in brands like Ford, Ram, and Chevrolet, offer in-house financing options. Dealership financing often comes with attractive incentives like:

- Zero down payment offers, make it easier for you to drive away with a new truck without needing a large initial investment.

- Low or 0% APR financing for qualified buyers, significantly reducing the overall cost of financing.

- The convenience of handling the financing process directly at the dealership, saves you time and effort.

One of the biggest advantages of dealership financing is the flexibility and speed of approval. Dealerships often work with a network of lenders, increasing your chances of getting approved, even if your credit is less than stellar. However, it’s important to carefully read the fine print to ensure there are no hidden fees or inflated interest rates, especially for longer loan terms.

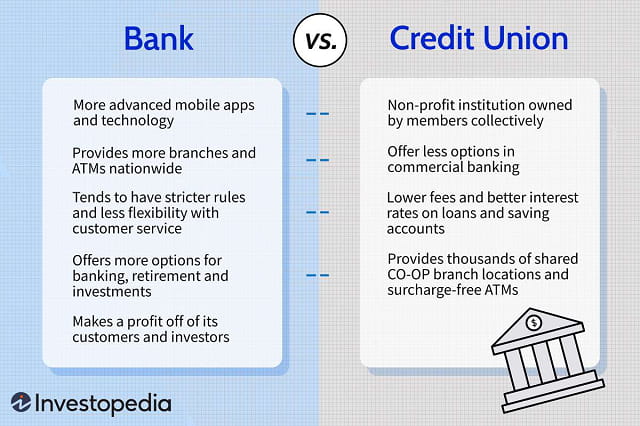

3. Credit Unions

Credit unions in Portland often provide lower interest rates compared to traditional banks and other lenders. They are a popular choice among Portland residents due to their member-focused approach and lower fees. Some benefits of financing through a credit union include:

- Lower interest rates, which means you’ll pay less over the life of the loan.

- Personalized service, with many credit unions offering more flexible repayment plans and terms compared to traditional lenders.

- Easier qualification requirements, can be a lifesaver for individuals or small business owners with less-than-perfect credit scores.

To take advantage of credit union financing, you typically need to be a member, but membership is often easy to obtain.

4. Online Lenders

Online lenders have made truck financing more accessible than ever, offering fast approvals and competitive rates. Many online lenders in Portland can approve loans within 24 to 48 hours, and the process can be completed entirely online. Some advantages of using an online lender include:

- Faster approval process, as online lenders often have streamlined procedures that skip much of the paperwork required by traditional banks.

- Competitive rates, which are often lower than those offered by brick-and-mortar banks, especially for borrowers with excellent credit.

- Flexible terms, including options for longer loan terms or no down payment, depending on your credit score and financial situation.

Online lenders can be a great option if you need quick financing, but it’s essential to compare offers carefully to avoid higher fees or interest rates in the long term.

5. Truck Leasing

Leasing is another popular option, particularly for business owners looking to refresh their fleet every few years. When you lease a truck, you’re essentially renting it for a set term (typically 24 to 60 months), after which you return the vehicle or have the option to purchase it outright. Leasing benefits include:

- Lower monthly payments, since you’re only paying for the truck’s depreciation during the lease term.

- Minimal upfront costs, as leases often require little to no down payment.

- The ability to upgrade to a newer model at the end of the lease term, makes it a good choice for businesses that want to stay current with the latest technology and safety features.

However, keep in mind that leasing may come with mileage limits and restrictions on truck modifications, which could be a drawback for some businesses.

How to Get Approved for Truck Financing in Portland

Getting approved for truck financing in Portland can be a quick and straightforward process if you take the right steps. Here’s what you can do to improve your chances of getting fast approval:

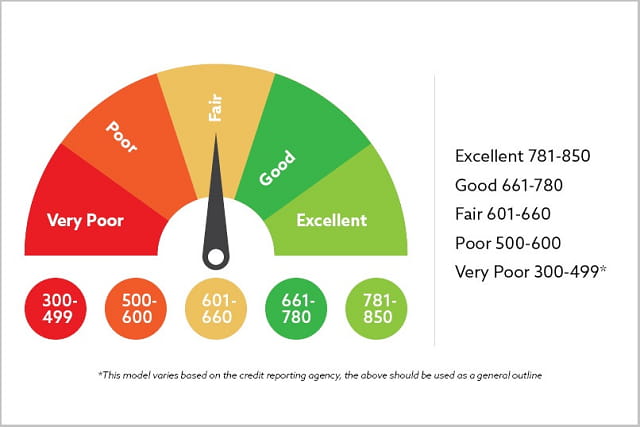

1. Check Your Credit Score

Your credit score plays a significant role in determining whether you qualify for truck financing and what interest rate you’ll receive. Before applying for a loan, check your credit score and resolve any errors or outstanding issues that might negatively affect your score.

2. Save for a Down Payment

A larger down payment reduces the amount you need to borrow, making you a less risky borrower in the eyes of lenders. Saving for a down payment can also help lower your monthly payments and reduce the total interest paid over the life of the loan.

3. Pre-Qualify for Financing

Many lenders offer the option to pre-qualify for a loan before you start shopping for a truck. Pre-qualification gives you an idea of what loan amount and interest rate you qualify for, helping you budget more effectively and avoid overspending.

4. Gather Documentation

When applying for truck financing, you’ll typically need to provide proof of income, bank statements, tax returns, and other financial documents. Having these documents ready can speed up the approval process and demonstrate to lenders that you’re financially capable of making the payments.

5. Shop Around for the Best Rates

Finally, it’s crucial to compare loan offers from different lenders to ensure you’re getting the best deal. Don’t just settle for the first offer you receive—take the time to look at different financing options, including those from banks, credit unions, dealerships, and online lenders.

Conclusion

Securing the right truck financing in Portland doesn’t have to be a complicated process. By understanding your options and taking the necessary steps to improve your credit and financial profile, you can get approved quickly and drive away in the truck of your dreams. Whether you’re looking to finance a Ram 3500 for personal use or expand your business fleet, there are plenty of financing options that cater to your needs.